Exchange-traded funds (ETFs) began as straightforward investment vehicles, allowing investors to buy a single fund - like VOO or SPY - and instantly gain exposure to a diversified stock portfolio, often mirroring classic index products.

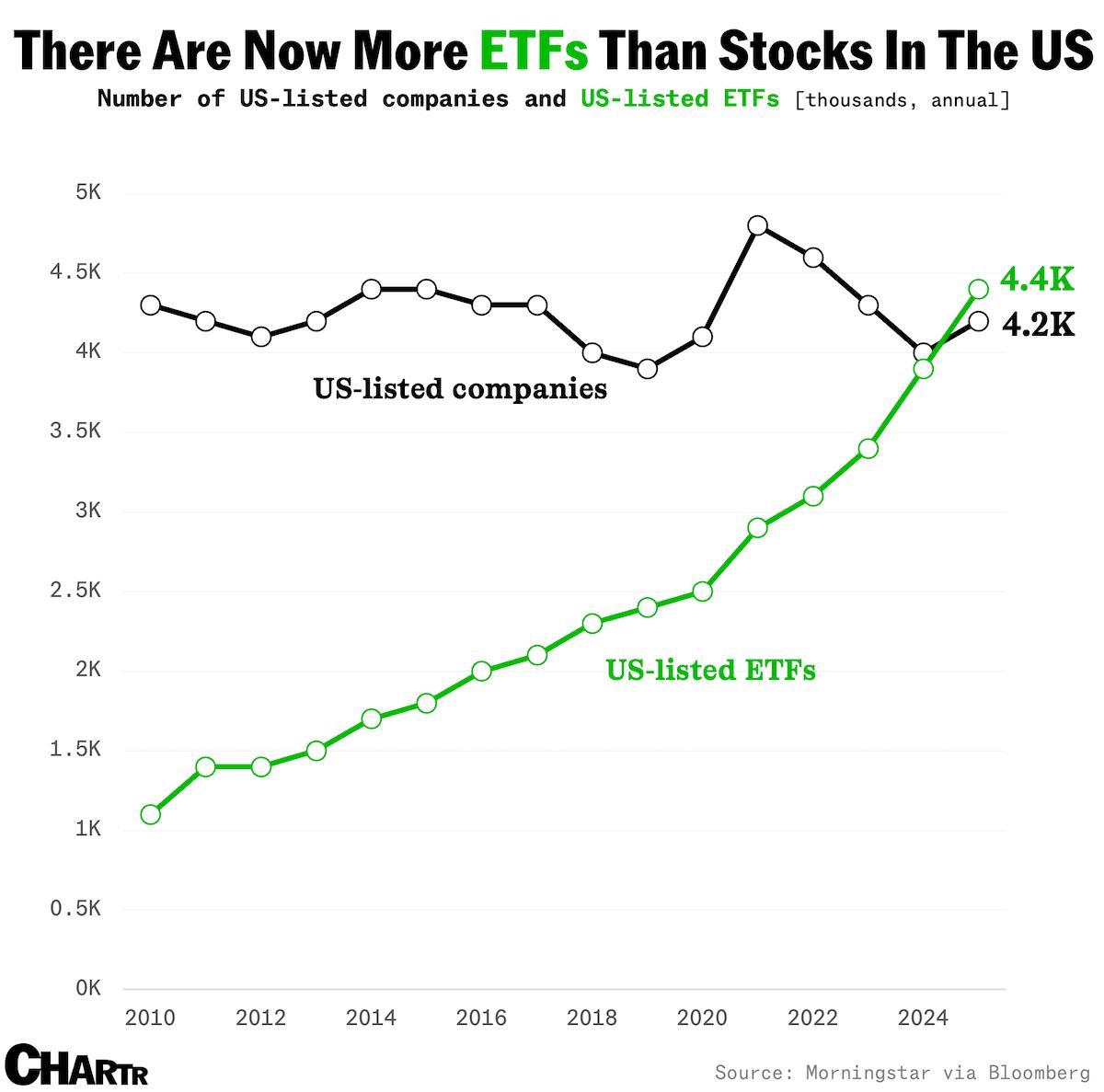

However, the industry has since grown far more intricate. What started with a few basic “recipes” has ballooned into thousands of variations, blending the same core ingredients - stocks of giants like Apple - into increasingly creative funds.

However, the industry has since grown far more intricate. What started with a few basic “recipes” has ballooned into thousands of variations, blending the same core ingredients - stocks of giants like Apple - into increasingly creative funds.

A standout trend is the surge in active ETFs. Once a niche, they accounted for just 3% of new investments in 2015; today, that figure has soared to 37%.

Unlike passive funds, which passively track indices, active ETFs are managed by humans aiming to outperform the market, albeit with higher fees.

This category includes traditional strategies like value, momentum, and income, alongside niche offerings such as the YALL Conservative Investors Fund and the VICE Sinful Stocks Fund, catering to specific investor tastes.

Also read:

- LinkedIn Creators Rejoice: New Analytics Features Bring Saves, Shares, and Growth Insights to the Forefront

- Google Discover's New "Follow Creators" Feature: Reinventing the RSS Wheel

- From Adventure Vlogger to Revolution Witness: How WeHateTheCold Captured Nepal's Gen Z Uprising

With over 4,400 ETFs now available and $664 billion poured into them in the first seven months of 2025 alone, the market has transformed into a vast landscape of flavors and ideas. This explosion of options empowers investors but also demands greater diligence to navigate the maze. While the diversity reflects innovation, it raises questions about whether the complexity truly benefits investors or simply serves as a playground for financial creativity - leaving many to wonder if the original simplicity of ETFs has been lost in the shuffle.