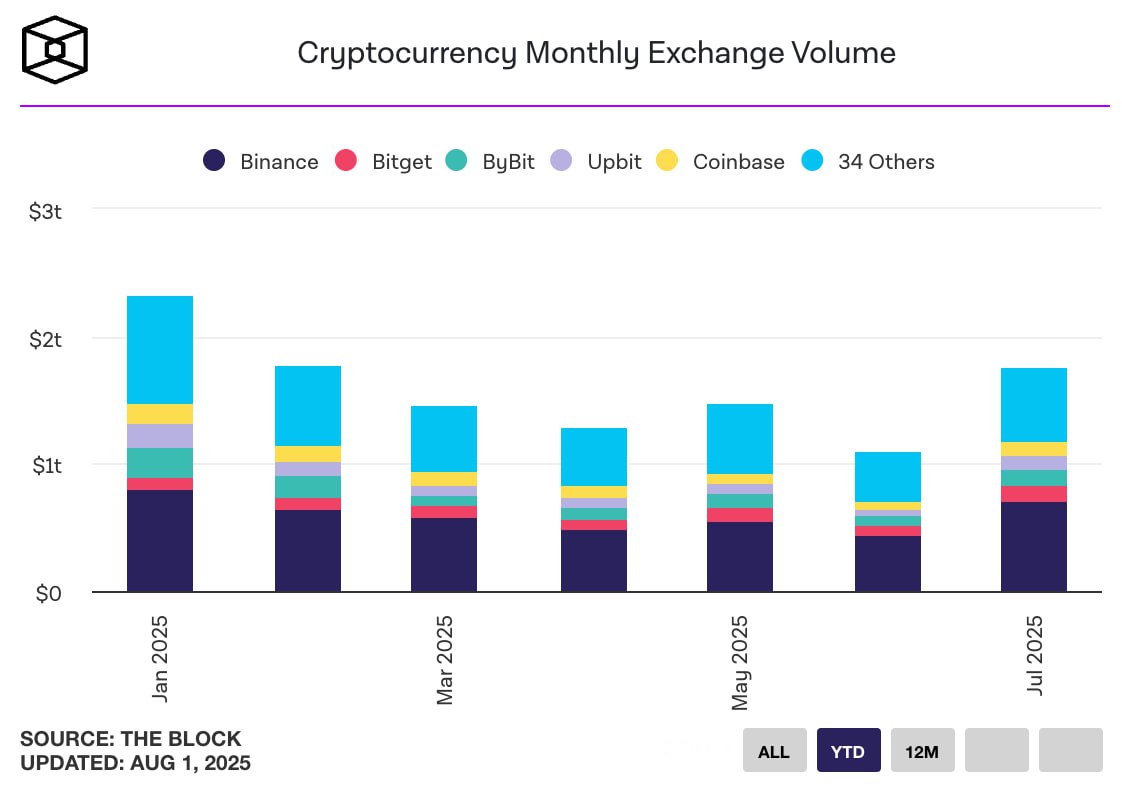

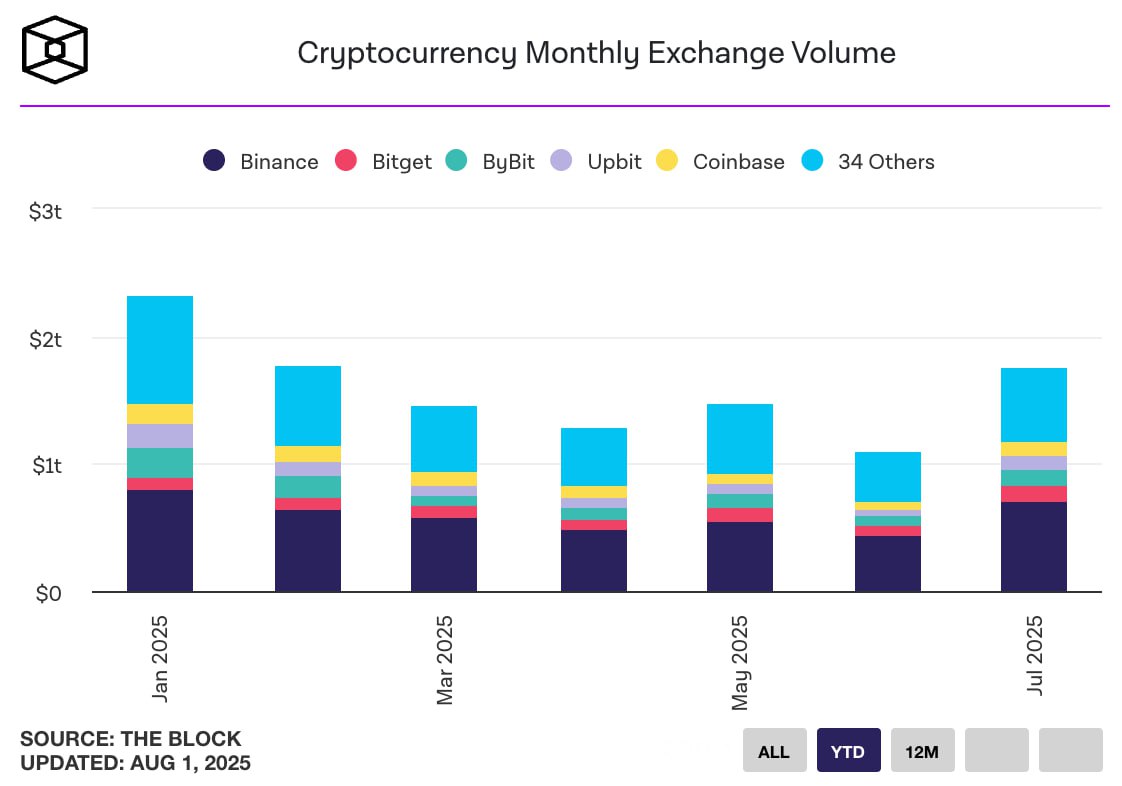

The cryptocurrency market roared back to life in July, with total trading volume across exchanges soaring to $1.71 trillion, a 55% jump from June’s $1.1 trillion, according to data from The Block. This marks the highest volume since February, when trading peaked at $1.77 trillion, signaling a robust resurgence in market activity.

Binance maintained its dominance, leading the pack with a staggering $683.4 billion in volume, up from $436.2 billion the previous month.

Binance maintained its dominance, leading the pack with a staggering $683.4 billion in volume, up from $436.2 billion the previous month.

This represents the platform’s strongest performance since January, underscoring its enduring appeal amid the market’s upward swing. Trailing behind are Bitget with $126 billion, Bybit with $122.3 billion, and Upbit with $110.2 billion, rounding out the top tier of centralized exchanges.

The surge in trading volume aligns with a notable rally in the crypto market during July. Bitcoin hit a new all-time high, gaining 7.5% over the month, while Ethereum saw an impressive nearly 50% increase, driving heightened investor interest. This bullish momentum has fueled activity across both centralized and decentralized platforms.

Also read:

- "Together" Emerges as a Body Horror Masterpiece, Earning 98% on Rotten Tomatoes

- AI and Children: The Market is Massive

- Roblox: A Metaverse Vision Built on Kid-Friendly Games

Decentralized exchanges (DEXs) also saw a significant uptick, with trading volume reaching $435.3 billion — the best since January. Leading the DEX charge was PancakeSwap, which recorded an impressive $188.6 billion, reflecting the growing popularity of decentralized trading ecosystems. As of August 2, 2025, this surge suggests the crypto market may be entering a sustained period of growth, with traders and investors capitalizing on the current bullish trends.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).