In a surprising turn of events, TikTok Live has overtaken Twitch to claim the title of the second most-watched livestreaming platform globally in Q1 2025, according to a recent report by StreamsCharts.

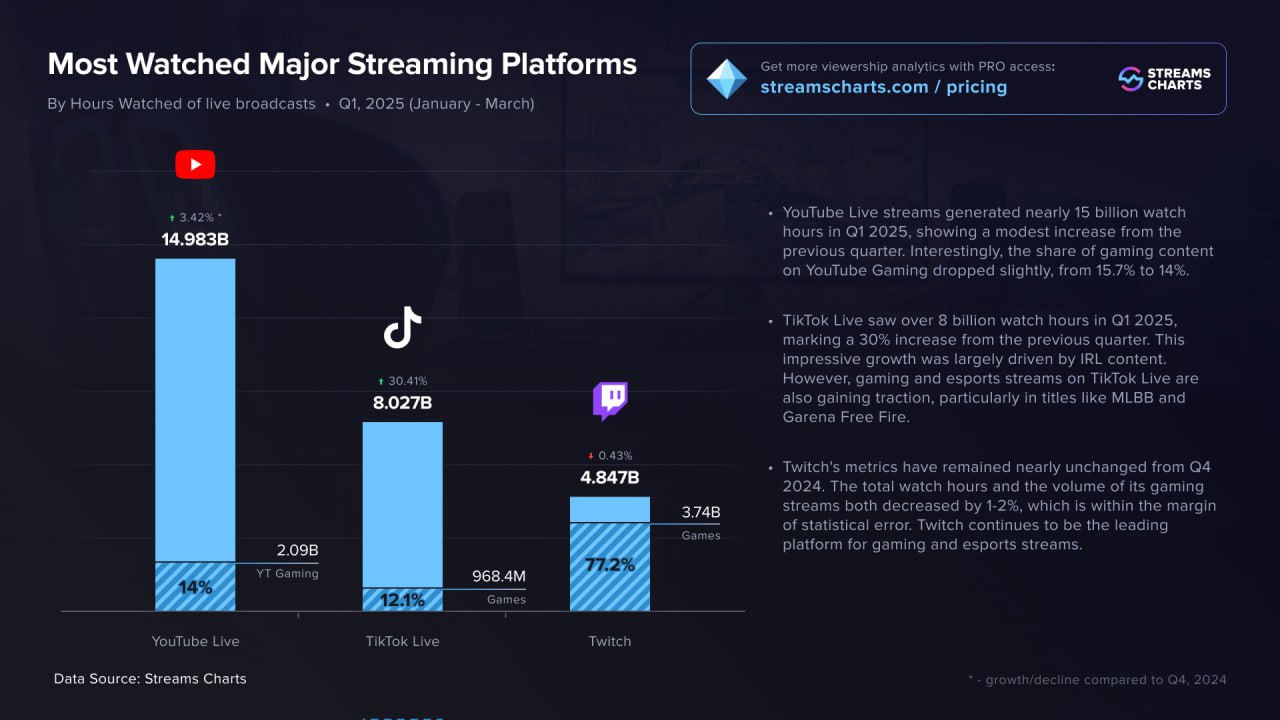

With an impressive 30% growth in viewership, TikTok Live racked up 8.027 billion hours watched, securing 27% of the total livestreaming market share. YouTube Live remains the undisputed leader with 14.983 billion hours watched (50.3%), while Twitch trails in third place with 4.847 billion hours (16.3%).

With an impressive 30% growth in viewership, TikTok Live racked up 8.027 billion hours watched, securing 27% of the total livestreaming market share. YouTube Live remains the undisputed leader with 14.983 billion hours watched (50.3%), while Twitch trails in third place with 4.847 billion hours (16.3%).

This shift highlights a growing trend in how audiences consume live content and raises questions about Twitch’s future if it fails to adapt.

TikTok’s Winning Formula: Mobile, Teens, and IRL Streams

TikTok Live’s meteoric rise can be attributed to three key factors: its mobile-first design, a strong teenage audience, and the surging popularity of IRL (In Real Life) streams.

TikTok Live’s meteoric rise can be attributed to three key factors: its mobile-first design, a strong teenage audience, and the surging popularity of IRL (In Real Life) streams.

Unlike Twitch, which has traditionally catered to a gaming-centric crowd, TikTok has capitalized on its accessibility and appeal to younger users who prefer short, spontaneous, and interactive content.

The platform’s mobile-centric nature gives it a significant edge, especially in regions like Southeast Asia and Latin America, where mobile-first viewing dominates. StreamsCharts’ Product Manager, Nazar Babenko, noted that “the mobile-centric nature of TikTok is a major factor in its rise,” emphasizing its seamless user experience on smartphones compared to Twitch’s lagging mobile UX.

Teenagers, particularly Gen Z, are a driving force behind TikTok Live’s growth. A 2025 survey revealed that 42.8% of Gen Z social media users watch livestreams weekly, significantly higher than the general population. TikTok’s algorithm excels at delivering trend-driven IRL content—such as casual chats, outdoor adventures, and fashion streams — that resonates with this demographic.

Teenagers, particularly Gen Z, are a driving force behind TikTok Live’s growth. A 2025 survey revealed that 42.8% of Gen Z social media users watch livestreams weekly, significantly higher than the general population. TikTok’s algorithm excels at delivering trend-driven IRL content—such as casual chats, outdoor adventures, and fashion streams — that resonates with this demographic.

Categories like Outdoors and Chats dominate TikTok Live, with the platform averaging 10 million hours watched weekly in the Outdoors category alone.

Meanwhile, Twitch’s focus on gaming, while still dominant with a 77% share in that sector, limits its appeal to broader audiences seeking diverse, non-gaming content.

Twitch’s Stagnation: A Gaming-Only Trap?

Twitch remains the king of gaming livestreams, boasting 240 million monthly active users and a strong foothold in esports, with 53% of the esports audience in Q1 2025.

Twitch remains the king of gaming livestreams, boasting 240 million monthly active users and a strong foothold in esports, with 53% of the esports audience in Q1 2025.

Popular gaming titles like League of Legends and Escape from Tarkov continue to draw millions of viewers, with the platform’s community-driven features — like real-time chat and emotes — fostering deep engagement.

However, Twitch’s heavy reliance on gaming content may be its Achilles’ heel. While gaming streams still account for the majority of its 4.847 billion hours watched, the platform saw an 11.8% decline in overall viewership from Q1 to Q2 2024, a trend that appears to have continued into 2025.

Critics argue that Twitch’s failure to diversify beyond gaming could lead to stagnation—or worse. Some industry observers on platforms like X have even speculated that Twitch might face a “death” within 3-5 years if it doesn’t evolve. The platform has struggled to keep up with the rising demand for IRL and lifestyle content, where TikTok and YouTube Live excel.

Also read:

- Spotify Pays Over $100 Million to Podcasters and Creators in Q1 2025, Intensifying Competition with YouTube

- The YouTube Paradox: Why Longer Videos Dominate Despite Viewer Preferences

- The Battle for Creators: Netflix, Peacock, and Disney Chase YouTube Stars

YouTube, for instance, captures a broader audience with retransmissions of TV channels, sports events, and non-gaming categories like Entertainment, amassing 100-200 million hours watched weekly in those segments.

YouTube, for instance, captures a broader audience with retransmissions of TV channels, sports events, and non-gaming categories like Entertainment, amassing 100-200 million hours watched weekly in those segments.

Twitch’s Just Chatting category, while popular with 2.86 billion hours watched in 2023, pales in comparison to TikTok’s Chats, which can generate up to ten times more viewership when combined with YouTube’s non-gaming categories.

Moreover, Twitch’s mobile experience has been criticized as subpar compared to TikTok and YouTube, a significant drawback in an era where over 5.6 billion people access the internet via mobile devices.

Babenko suggests that Twitch must “innovate in creator tools and monetization options” to prevent talent migration to competitors like TikTok, YouTube, and Kick, which saw a 28% increase in viewership in Q2 2024. Expanding localization in emerging markets, where mobile-first viewing is surging, could also help Twitch regain ground.

The Future of Livestreaming: Adapt or Fade

TikTok Live’s 30% growth in Q1 2025 signals a shift in the livestreaming landscape, where mobile accessibility and diverse content are becoming key drivers of viewership.

While TikTok is unlikely to catch up to YouTube’s robust ecosystem — bolstered by long-form content, sports, and global brand presence — it has carved out a niche that Twitch can no longer ignore.

TikTok’s focus on mobile games like Mobile Legends: Bang Bang and Garena Free Fire also positions it to dominate a gaming segment that Twitch and YouTube have largely overlooked.

For Twitch, the path forward requires a hard pivot. Doubling down on gaming alone risks alienating a growing audience that craves variety. To survive, Twitch may need to rethink its mobile strategy, invest in creator tools, and embrace non-gaming content more aggressively.

Otherwise, as TikTok and YouTube continue to innovate, Twitch’s once-dominant position in livestreaming could become a relic of the past. The next few years will be critical for Twitch to prove it can adapt—or face the grim predictions of its decline.

On topic:

- Spotify Pays Over $100 Million to Podcasters and Creators in Q1 2025, Intensifying Competition with YouTube

- Substack Surges: 1 Million Paid Subscribers Added in Just Four Months

- The Creator Economy Matures: Kajabi’s 2025 State of Creator Commerce Report Highlights Shift to Ownership and Business Mindset

Thank you!