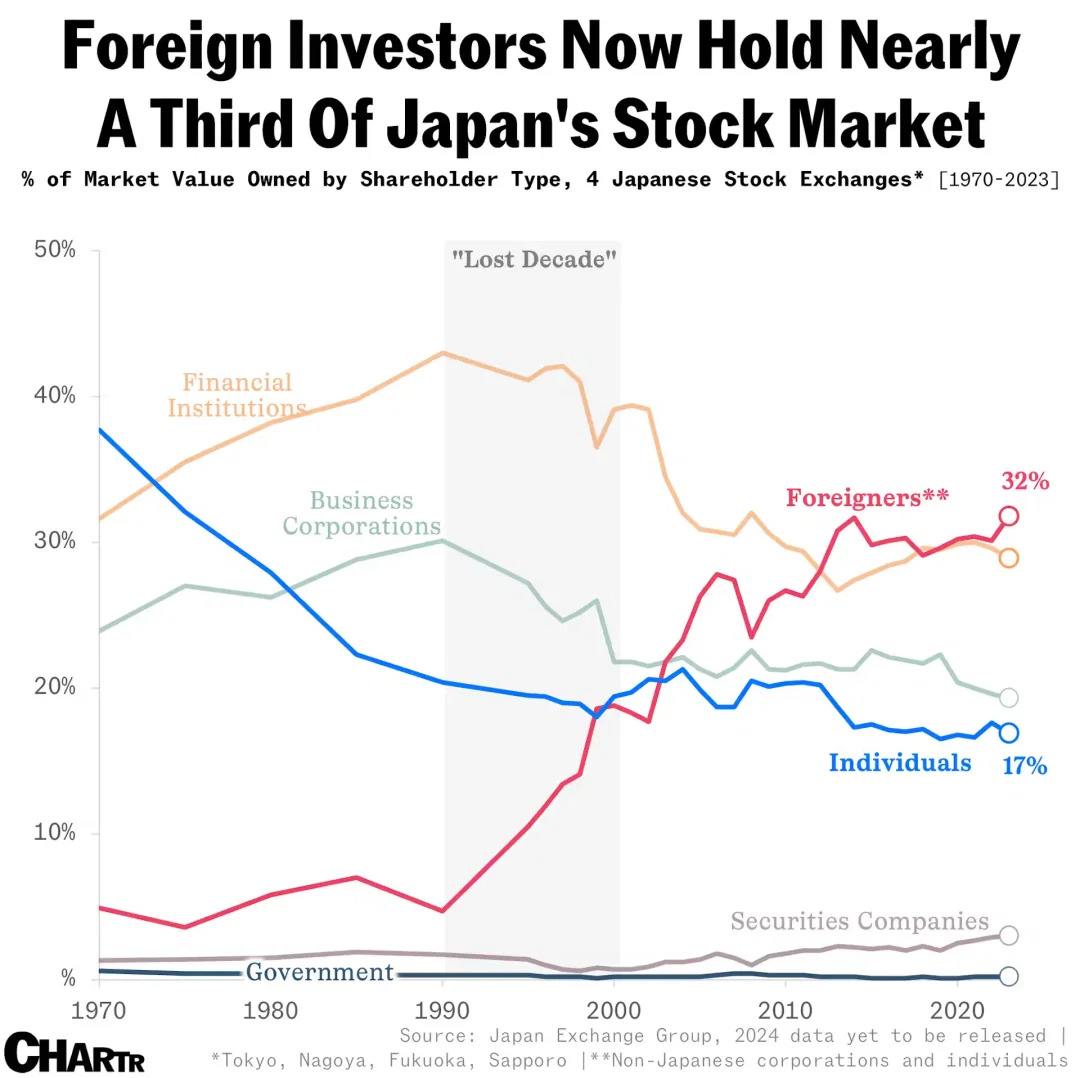

Recent data from the Tokyo Stock Exchange (TSE) reveals a striking shift in Japan’s financial landscape: foreign investors now own 32% of the country’s stock market, a sharp rise from just 5% in the 1970s.

In contrast, Japanese retail investors hold a mere 17%, highlighting a growing disparity that could widen further. In April, as U.S. stocks faltered amid tariff threats, foreign investors poured a net $8.3 billion into Japanese equities, underscoring their confidence in Japan’s market.

In contrast, Japanese retail investors hold a mere 17%, highlighting a growing disparity that could widen further. In April, as U.S. stocks faltered amid tariff threats, foreign investors poured a net $8.3 billion into Japanese equities, underscoring their confidence in Japan’s market.

This trend reflects Japan’s increasing integration into global finance, but it also raises concerns about local participation. To counter this, Japan is taking bold steps to engage its younger generations.

The TSE plans to lower the minimum investment threshold, making stocks more accessible to retail investors.

Also read:

Also read:

- Quentin Tarantino Declares 2019 the Last Year of "Real Cinema" Before Streaming Took Over

- TikTokers Are Wearing Apple Watches on Their Ankles — And It’s Not a Fashion Statement

- Google Maps Now Plans Your Travel Routes Using Instagram Screenshots

Additionally, the government expanded tax incentives for individual investors last year, aiming to spur domestic participation.

Efforts to boost financial literacy among millennials and Gen Z are also gaining traction. Programs promoting investment education are helping reshape attitudes toward wealth-building.

The results are promising: according to the Investment Trusts Association, 36% of Japanese individuals in their 20s invested in mutual funds, stocks, or bonds last year — nearly triple the figure from 2016.

The results are promising: according to the Investment Trusts Association, 36% of Japanese individuals in their 20s invested in mutual funds, stocks, or bonds last year — nearly triple the figure from 2016.

These initiatives signal Japan’s determination to cultivate a new generation of investors.

However, with foreign investors continuing to dominate, the gap in market ownership remains a challenge.

As Japan balances global appeal with domestic engagement, its success in empowering young investors could shape the future of its financial markets.

Might be interesting:

- Japan Launches Wooden Satellite

- Japan Working on "Conveyor Belt Road" Between Tokyo and Osaka

- Born in Winter, Built for Cold: Japanese Study Reveals Why "Winter Babies" Stay Lean and Warm

- Mount Fuji Snowless For Longest Time In 130 Years

Until next time!

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).